Retirement Open House for Karla

Post thumbnail

Post thumbnail

Retirement Open House for Karla

Cheers to 27 years!

A retirement open house to honor Karla, Tuesday, December 30th, 2025 from 1:00-3:00pm in the Credit Union Lobby

Post thumbnail

Post thumbnail

Retirement Open House for Karla

Cheers to 27 years!

A retirement open house to honor Karla, Tuesday, December 30th, 2025 from 1:00-3:00pm in the Credit Union Lobby

Post thumbnail

Post thumbnail

Thursday, June 26th, 2025 – 5:30pm ~ The KC Club, 2601 North Broadway, Minot.

Join us for dinner, AFFCU Swag, A Fraud Prevention Presentation and a chance to win some awesome prizes that are guaranteed to be a hit all summer long!

Tickets are $5 and can be purchased at the Credit Union

Post thumbnail

Post thumbnail

Affinity First will be closed Saturday, March 30th.

Post thumbnail

Post thumbnail

Recent news headlines have been full of warnings about gift card scams, including reports of arrests in

CA and AZ involving thousands of tampered gift cards. These timely reports can naturally make any of us

hesitant about purchasing gift cards whether it’s for a holiday or other special occasion. Knowledge,

however, is power and there are precautions you can take when shopping for gift cards.

You have a few options for safeguarding your gift card purchases. Using extra care when selecting gift

cards from the store rack is one place to start. Try taking cards from the back of the rack, checking for

tampered packaging, and requesting to remove the cards from their sleeves at the time of purchase to

see if the pin number has been scratched or cut off. Purchasing physical or virtual cards online from a

trusted website can be another option, though even legitimate websites can be compromised by

cyberattacks so care must be exercised online as well.

Another option is to buy gift cards from your credit union where you can gain instant access to these

popular gifts. Cards are stored behind the counter where they’re protected from tampering.

Credit union issued gift cards are also general use cards that give the recipient more shopping options.

They also come with convenient features that give cardholders additional safeguards including:

• The ability to track purchases online, making suspicious activity easier to spot.

• Allowing cardholders to choose their pin number when activating a gift card, which can frustrate

scammers.

While scammers may be getting bolder and more sophisticated in how they drain gift cards, you don’t

have to rethink giving these popular gifts this holiday season. You can take steps to protect yourself,

including choosing options from a trusted source like your credit union.

Post thumbnail

Post thumbnail

Santa will be at Affinity First FCU on Friday, December 8, 2022 from 3pm – 5pm! Free photos and Pets are welcome!

Post thumbnail

Post thumbnail

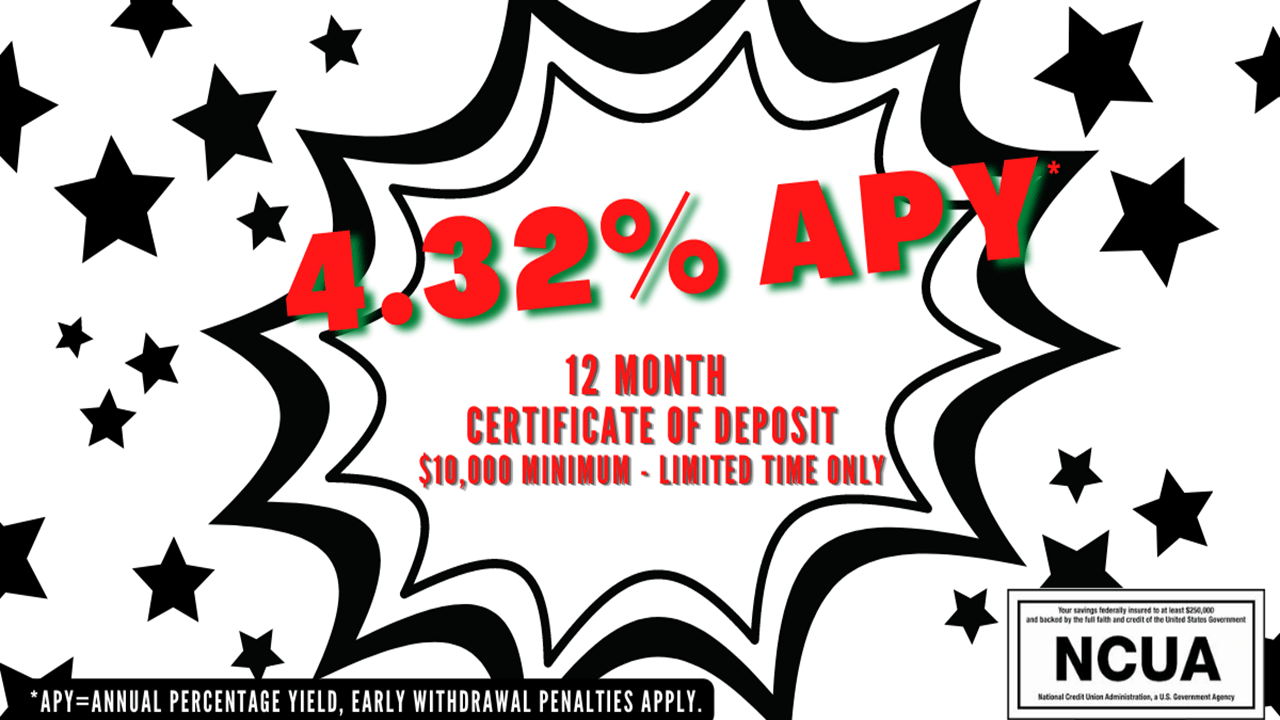

12 Month Certificate of Deposit at 4.32% APY*

Stop in today or give us a call to get your Certificate started today!

*Early withdrawal penalties do apply, $10,000.00 minimum deposit required, APY = Annual Percentage Yield, Member NCUA.

Post thumbnail

Post thumbnail

Affinity First FCU is searching for someone who is reliable and enthusiastic to join our team part-time as a Teller!

-No Teller experience required

-Sales experience preferred but not required

-Effective communication skills

-Flexible scheduling

-High school graduate

If you would like the opportunity of working with Affinity First, visit us at 811 S Broadway Ste A in Minot to fill out an application, or you can email your resume to Kelly at affinityfirst@srt.com.

Post thumbnail

Post thumbnail